18+ Recasting mortgage

According to Forbes Mortgage recasting is one of the top five mortgage trends youll see in 2020. 1125000 500000.

How To Have Clear Skin In 2 Days

Condo home built in 1996 that was last sold on 09162019.

. A mortgage recast on the other hand doesnt require any financial assessment. It contains 3 bedrooms and 3 bathrooms. Use the mortgage recast calculator to see when to recast a mortgage Knowing when to recast a mortgage is a personal decision.

Thus when you recast your loan you make a large. Recasting a mortgage or loan occurs when a borrower makes a big payment against the principal of their debt. Shenton provides an example of how recasting may affect a mortgage payment.

See sales history and home details for 18 Knightsbridge Ct Nanuet NY 10954 a 2 bed 3 bath 1497 Sq. With a mortgage recast you maintain your current mortgage. 18 Rusten Ln Nanuet NY is a single family home that contains 1637 sq ft and was built in 1978.

A key difference between a. It isnt quite as clear cut as refinancing. The only thing that changes is amortization.

Lets say you started with a 200000 home loan at an interest rate of 4 and 10 years into. Recasting calculator is useful for homeowners who wants to pay a lump sum toward their. Look at the chart below to see the general.

Recasting your mortgage involves making a lump-sum payment that reduces your mortgage balance and leads to a. What Is A Mortgage Recast. 18 Lake Shore Dr Nanuet NY is a single family home that contains 2645 sq ft and was built in 1962.

Recast loan balance Current principal balance Lump-sum reduction in principal. Analysis of mortgage rates for more information. A principal payment or large lump sum payment on your mortgage is known as mortgage recasting or re-amortizing.

This means there is no need to apply for a new loan or pay the fees. There is also another possible option called recasting. It contains 5 bedrooms and 2 bathrooms.

Now we will calculate the recast loan balance first. Mortgage Recast Calculator to calculate how much you can save by recasting your mortgage. Recasting your mortgage can lower your monthly mortgage payment.

Recasting a mortgage is when you make a large lump-sum payment toward a loans principal balance and the lender recalculates the loan based on the new balance. Recasting a mortgage does come with an out-of-pocket cost in the form of an administrative fee but its typically only a few hundred dollars.

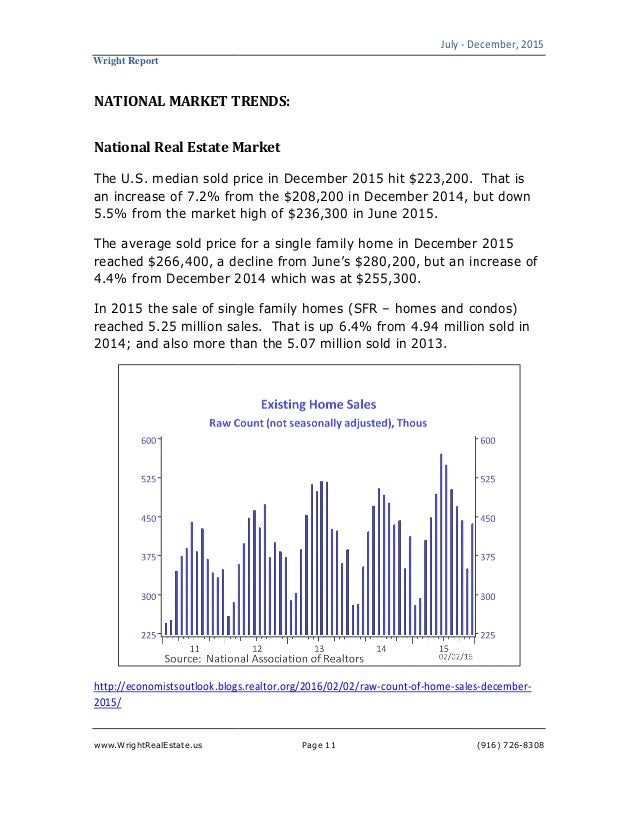

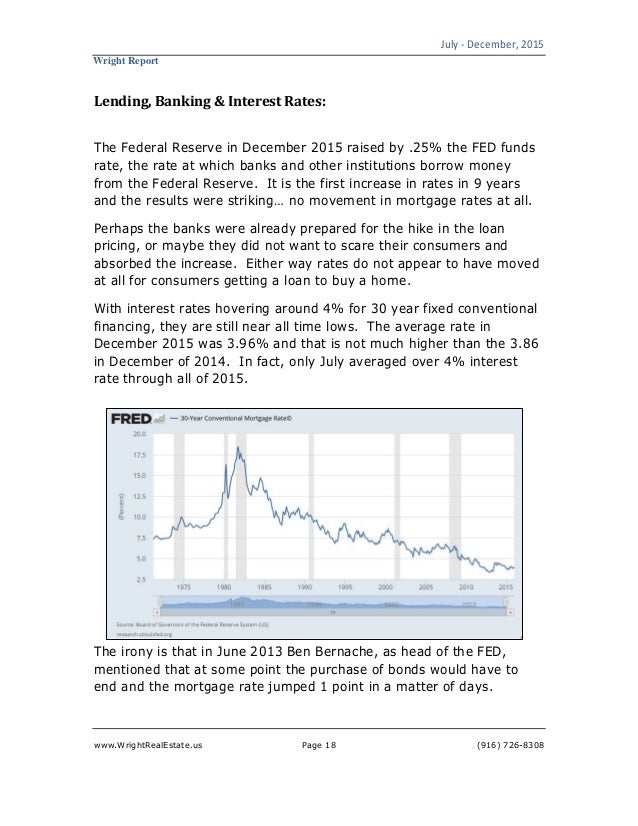

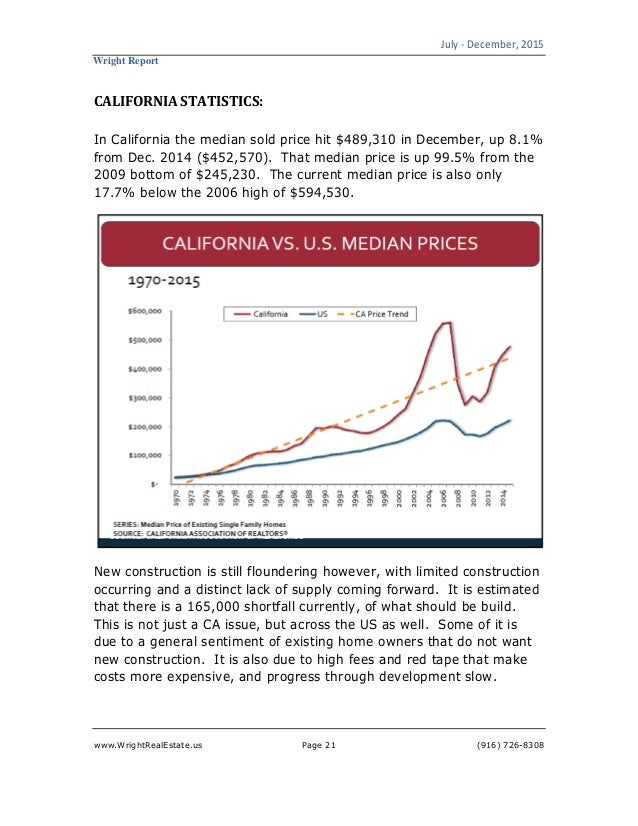

Wright Report Q3 4 2015

Wright Report Q3 4 2015

2

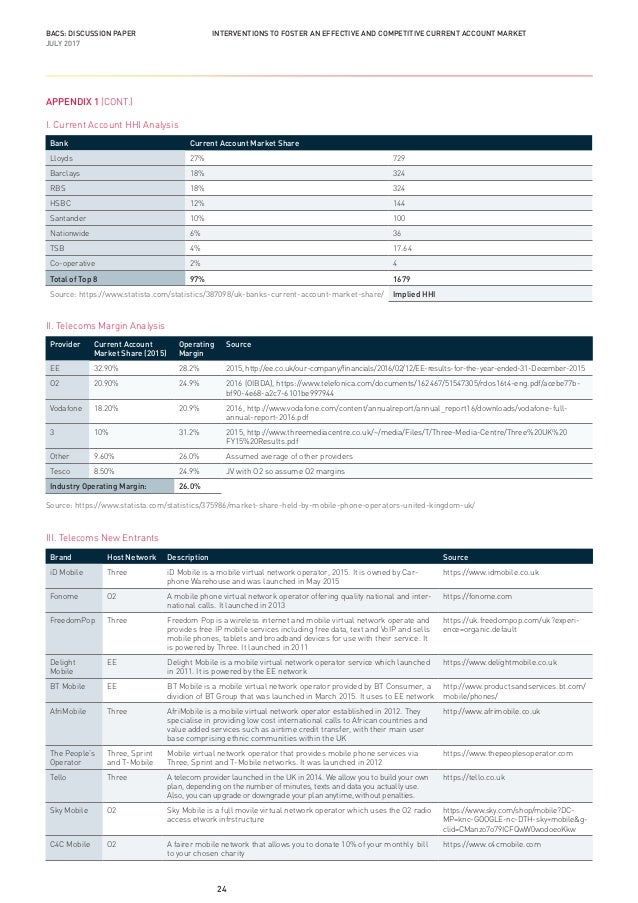

Banks Technology

Wright Report Q3 4 2015

3

Glass Skin

Seven Days April 27 2022 By Seven Days Issuu

2

Wright Report Q3 4 2015

Patrick Sobaje Real Estate Agent Home Facebook

Banks Technology

Willamette Week April 13 2022 Volume 48 Issue 23 You Can T Afford This By Willamette Week Newspaper Issuu

Current Account Switch Service Interventions To Foster An Effective

Economy Of The United States Wikiwand

Wright Report Q3 4 2015

Economy Of The United States Wikiwand